Internet Scams: A Growing Concern

How to Recognize and Avoid Modern Phishing Tricks

Digital literacy across all generations is constantly being tested in the virtual world. Holidays, discounts, and giveaway campaigns on social media create the perfect conditions for lowered awareness of online scams and phishing tricks, leading to an increasing number of victims and greater financial losses.

Fraudsters use sophisticated methods and fake content that can appear authentic even to experts. That is why it is crucial to stay informed about the latest phishing schemes and develop effective strategies to protect personal data in the digital space.

Below, you can read more about current internet scams, how to identify them, and ways to protect yourself when you encounter them.

Recent Phishing Attempts: What to Watch Out For

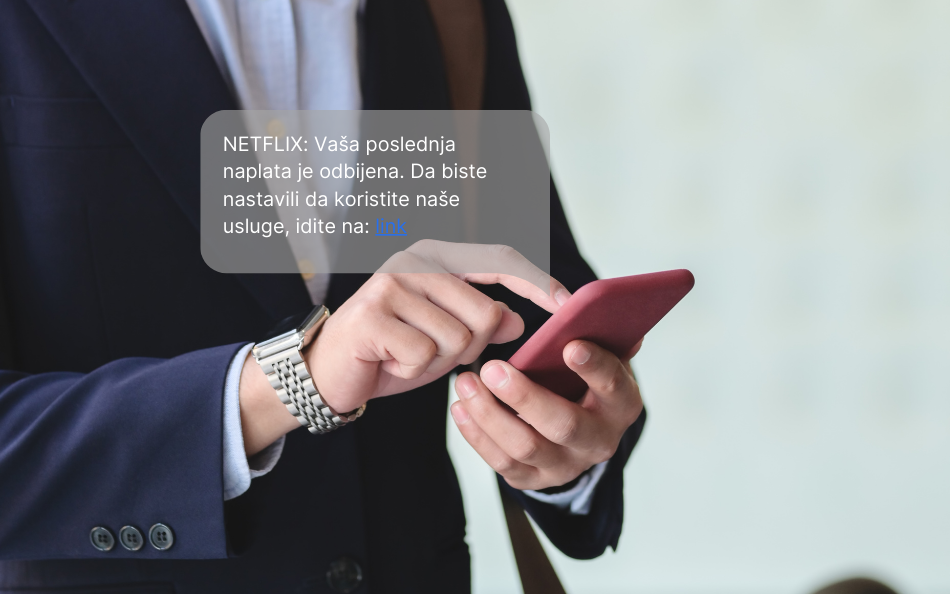

Recently, hackers have been sending fraudulent SMS messages to Netflix users, falsely informing them that their last subscription payment was declined. The link in the message directs them to a fake Netflix website where they are prompted to enter personal data. In such cases, always be cautious and suspect that the website may be collecting information for misuse. Netflix has officially stated that they will never request credit card numbers, bank account details, or account passwords.

Another example of SMS phishing was observed earlier in 2024 when Serbian citizens received fake notifications from “Pošta Srbije” (Serbian Post) claiming that a package was awaiting delivery, which would not be possible unless the recipient updated their details. This ongoing scam, which features a sophisticated user interface, aims to steal sensitive data such as credit card numbers and security codes.

A repeated phishing post appeared on the Facebook page of JGSP “Novi Sad,” falsely claiming that the public transportation company was offering a six-month free pass to Novi Sad residents upon purchasing an Nsmart card for 235 RSD. JGSP has warned citizens not to fall for this scam and to be cautious when sharing their data, including credit card and bank account details.

However, loan scams remain one of the most common types of phishing attacks. These fraudulent posts frequently appear on social media and contain details designed to appear legitimate even to cautious users. Victims are asked to pay an initial fee for supposed contract preparation and loan processing, followed by another smaller amount for “unexpected costs,” only to never receive the promised loan. Erste Bank has repeatedly warned its customers that financial products and services can only be arranged at official bank branches and through the mBanking and NetBanking applications. They strongly advise against falling for these types of scams.

How to Protect Yourself from Internet Scams

To safeguard yourself from online fraud and ensure your data is not misused, take the time to educate yourself on this topic. The Erste team advises extra caution when receiving emails or messages requesting personal information, such as passwords or payment card details. Always verify the credibility of the addresses and websites from which you receive messages.

If you become a victim of fraud, immediately contact your bank if you have shared financial information, report the incident to local authorities or relevant institutions, and change the passwords of all compromised accounts.

For more information on data protection and online fraud prevention, visit the Erste Bank website. Make the internet a safer place for yourself!

Related posts

Money Meetup: Women and money – How to achieve greater financial security?

Experts and entrepreneurs discuss economic challenges and women’s empowerment

Results of AmCham’s work presented and new Board members elected

Ana Drašković and Igor Lončarević join AmCham Board of Governors.

Over 36 million cyber attacks prevented and 160,000 visits to the #BoljiOnline platform

A1 Serbia marks safer Internet Day